Let’s Be Honest: Online Home Valuation Tools Are Helpful — But They’re Not the Whole Story

Let’s be honest—home valuation tools are great. They give us a quick way to see how our most valuable asset might be appreciating. And who doesn’t want to know that?

One of the most common questions I get is:

“How much do you think my home is worth?”

In most cases, homeowners and buyers already have a number in mind based on what they’ve seen online. The follow-up question is usually: Which site should I trust? Which one is the most accurate?

It sounds like a simple question. In reality, it’s not.

Why There’s No “Most Accurate” Valuation Tool

Most online home valuation tools are powered by complex algorithms. On paper, it’s easy to assume a computer should be able to calculate value more accurately than a person.

The problem? Every home is unique.

These models rely heavily on public data, market trends, and recent sales—but they struggle to account for the actual quality of a home. That’s where the gaps start to show.

Let’s get into the good, the bad, and sometimes the ugly.

The Bad (and Sometimes the Ugly)

Here’s what automated valuation models consistently miss:

1. Condition and Quality

No matter how advanced the algorithm, it can’t see inside your home.

Imagine two houses with the same bedrooms, bathrooms, style, and location. One has been completely updated; the other hasn’t been touched in 30 years. The model may say they’re worth the same—but are they? Almost certainly not.

2. Layout and Livability

This is something many people overlook, but buyers don’t.

Just today, I showed a home where the buyer was genuinely confused by the layout. Does that affect value? Possibly. And it’s not something an algorithm can easily quantify.

3. Micro-Location Differences

Two identical homes half a mile apart might look equal on paper—but location still matters.

A house on a busy road versus one tucked into a quiet neighborhood will often command different prices. How much of a difference? That’s where an experienced agent or appraiser comes in. Valuation models simply aren’t there yet.

4. Market Momentum and Buyer Behavior

Real estate markets shift quickly. What was true last month—or even last week—may not reflect current buyer demand.

Automated models rely on closed sales, which means they’re always looking in the rearview mirror. A good local agent understands what’s happening right now.

5. Comparable Selection Errors

This is the most common issue I see.

Models don’t always choose the best comparable properties. A two-story home in the suburbs shouldn’t be compared to a ranch next door—yet it happens more often than you’d expect. When the comps are off, the valuation will be too.

The Good

At this point, you might think I’m against online valuation tools. I’m not.

They absolutely serve a purpose.

These tools can:

• Provide a general sense of market direction

• Offer a rough idea of home value

• Help track neighborhood trends over time

If you’re simply curious and not planning to sell, this information is often good enough as a baseline.

Where things go wrong is when these tools are treated as pricing strategies. They’re not designed for that.

So What Is the Best Way to Value a Home?

For the most accurate valuation, you need a professional to physically walk through the property—inside and out.

• A proper valuation includes:

• An in-person walkthrough

• Questions about updates, improvements, and condition

• A detailed review of truly comparable homes

• An understanding of current market demand

(Not an exhaustive list)

All of that gets compiled into a Comparative Market Analysis (CMA), which is still the most reliable way to determine value in today’s market.

The key—whether you’re buying or selling—is to avoid pricing emotionally or algorithmically. Review the data, ask questions, and make decisions with context.

That’s where having the right agent matters.

My Personal Ranking of Online Home Valuation Tools

Based on my experience, here’s how I’d rank the most common tools:

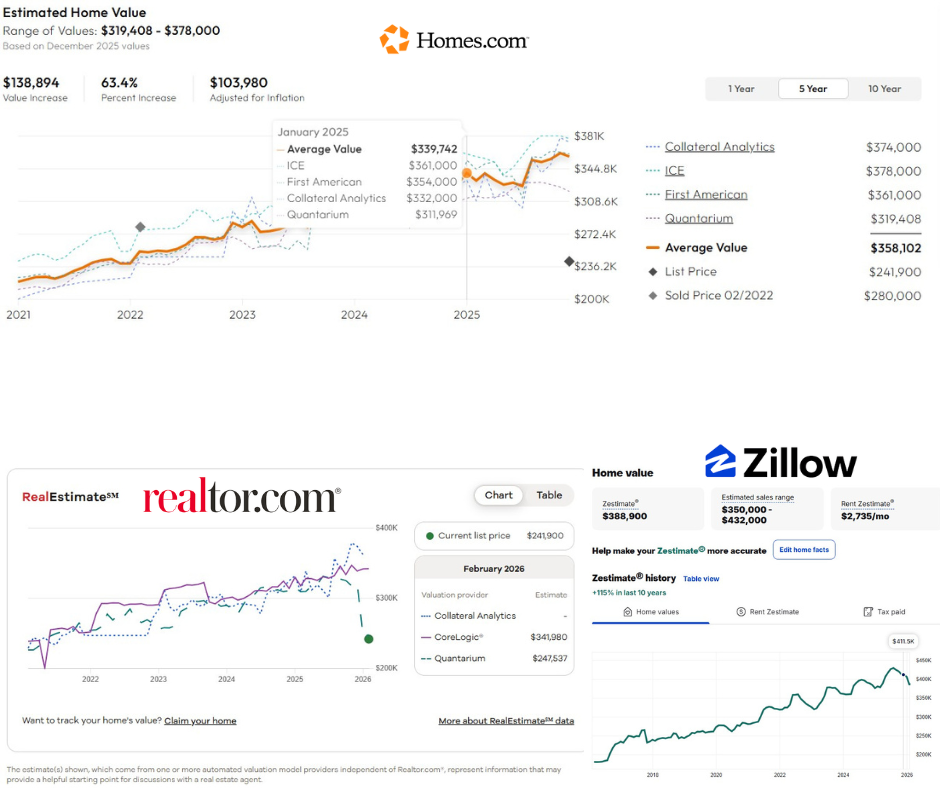

1. Homes.com

This is my favorite. It allows you to view multiple valuation models in a clean, easy-to-read chart. The valuations come from independent providers, which helps give a broader perspective. The site itself is also easy to navigate.

2. Realtor.com

Very similar to Homes.com in that it displays multiple valuation models from independent sources. The interface feels a bit clunkier, but overall it’s still a solid option.

3. Zillow Zestimate

This is the most widely recognized tool—and for good reason. Zillow has improved its model significantly over the years. That said, it can still be off at times for all the reasons mentioned above.

It’s useful for getting a general idea of value and tracking neighborhood trends.

Final Thought

Online valuation tools are a great starting point—just not the finish line.

If you want to know what your home is actually worth in today’s market, nothing replaces local knowledge, professional analysis, and real-world context.

And if you’re ever unsure, ask questions. That’s what we’re here for.